International trade finance programs facilitate global commerce by providing tailored financial solutions, including commercial real estate loans (CREL) in Denver and other international hubs. These initiatives empower businesses to expand globally, manage risks, and foster market exploration, investment security, and currency management. Denver leverages CREL to fuel economic growth through critical infrastructure development, attracting foreign direct investment and enhancing its position as a premier trade finance hub. By understanding and managing risks effectively, businesses can use CREL strategically for global expansion while protecting local assets, boosting growth in Denver's dynamic real estate market.

International trade finance programs facilitate global commerce, fostering economic growth and connectivity. This article delves into the intricate world of these programs, offering a comprehensive view from a global lens. We explore their impact on Denver’s vibrant international trade network, particularly highlighting the role of commercial real estate loans in driving investment and expansion. Furthermore, we provide strategic insights for businesses navigating risks and reaping benefits in this dynamic market, supported by compelling case studies from Denver’s real estate sector.

- Understanding International Trade Finance Programs: A Global Perspective

- The Role of Commercial Real Estate Loans in Denver's International Trade Network

- Navigating Risks and Benefits: Strategies for Businesses in Denver's International Market

- Case Studies: Successful International Trade Finance Programs in Denver's Real Estate Sector

Understanding International Trade Finance Programs: A Global Perspective

International trade finance programs are a vital component in facilitating global commerce, enabling businesses to navigate the complex landscape of cross-border transactions. These programs offer a range of financial tools and services designed to support companies engaged in international trade, especially those operating in diverse sectors like commercial real estate. In the vibrant, interconnected world of business, understanding these finance initiatives is crucial for fostering growth and ensuring stable economic relationships between nations.

One key aspect to consider is how these programs can facilitate access to capital, such as commercial real estate loans in Denver or other global hubs, allowing businesses to expand their operations internationally. By providing financial backing, insurance, and risk mitigation strategies, trade finance enables companies to explore new markets, secure investments, and manage potential currency fluctuations. This, in turn, contributes to the overall growth of international trade networks and creates a more robust economic environment for all participants.

The Role of Commercial Real Estate Loans in Denver's International Trade Network

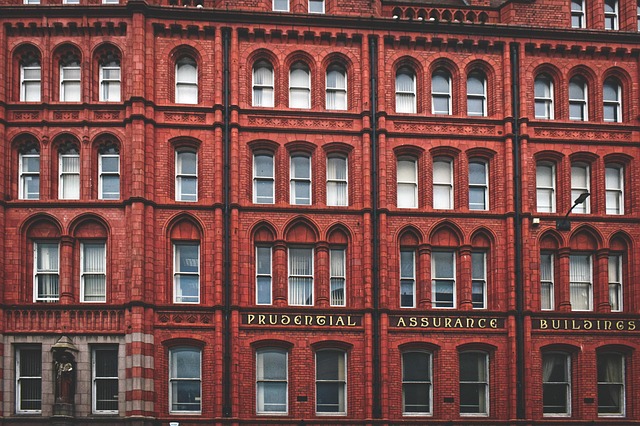

Denver, a thriving international trade hub, leverages Commercial Real Estate Loans (CREL) as a strategic tool to fuel its economic growth and enhance its global connectivity. These loans play a pivotal role in financing the development of commercial properties, such as warehouses, logistics centers, and office spaces, which are essential infrastructure for facilitating international trade activities. By providing funding for these assets, CREL supports the expansion of businesses involved in importing and exporting goods, thereby strengthening Denver’s position in the global supply chain.

The availability of CREL encourages investment in high-quality real estate projects that cater to the needs of multinational corporations and e-commerce giants. These loans enable developers and entrepreneurs to construct modern facilities with advanced logistics capabilities, attracting foreign direct investment (FDI) and fostering a vibrant business ecosystem. As Denver’s international trade network expands, so does the demand for CREL, creating a symbiotic relationship that drives economic prosperity and positions the city as a premier trade finance hub in the region.

Navigating Risks and Benefits: Strategies for Businesses in Denver's International Market

Navigating the international market can present a unique set of challenges and opportunities for businesses in Denver. One of the key considerations is understanding and managing risks, especially when it comes to financing. International trade finance programs offer a range of tools to support companies in their global endeavors, but it’s crucial to identify which strategies align with individual business needs.

For instance, securing commercial real estate loans in Denver can be a strategic move for businesses looking to expand internationally. These loans provide stability and leverage, allowing companies to invest in foreign markets while ensuring local assets are protected. By carefully assessing risk exposure and leveraging the right finance programs, businesses can mitigate potential losses and capitalize on global growth opportunities.

Case Studies: Successful International Trade Finance Programs in Denver's Real Estate Sector

In the vibrant real estate sector of Denver, several international trade finance programs have proven successful in fostering growth and expansion. These initiatives have played a pivotal role in facilitating access to capital for commercial real estate projects, leading to increased investment and development across the city. One notable example is the establishment of specialized financial institutions that offer tailored commercial real estate loans denver, catering specifically to the unique needs of international investors and developers.

Through innovative financing models and partnerships with local authorities, these programs have attracted significant foreign investment into Denver’s commercial property market. This influx has resulted in the development of high-end office spaces, mixed-use complexes, and modern industrial facilities, contributing to the city’s economic diversification and enhancing its reputation as a premier real estate destination on the global stage.

International trade finance programs, particularly those focused on commercial real estate loans in Denver, play a pivotal role in fostering global economic connections. By understanding the intricate dynamics of these programs and implementing strategic risk management, businesses within Denver’s international trade network can unlock significant opportunities. The case studies presented highlight successful models, offering valuable insights for navigating the complexities of international markets. As Denver continues to thrive as a global hub, leveraging these finance programs will be key to sustaining growth and ensuring a prosperous future for the city’s diverse real estate sector.